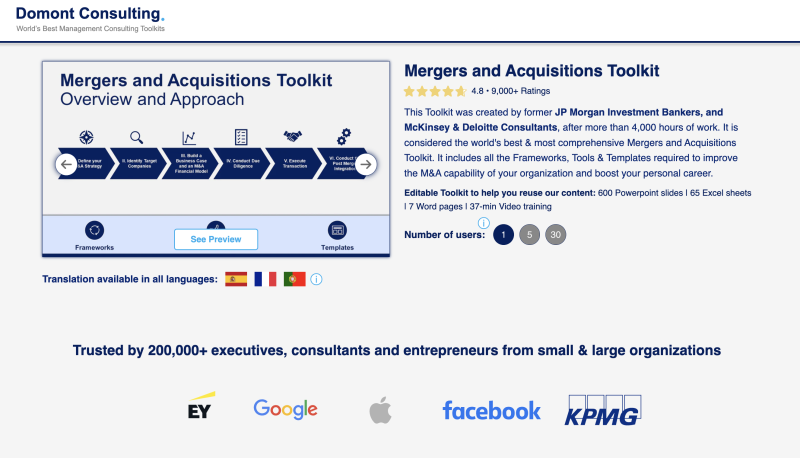

Home » Membership » Domont Consulting – Mergers and Acquisitions Toolkit

Domont Consulting – Mergers and Acquisitions Toolkit

$1,990.00 Original price was: $1,990.00.$34.99Current price is: $34.99.

If You Want to Pay Via Credit/Debit Card just Contact Us On Site Chat or Email: [email protected]

IMPORTANT

Product is not part of the Membership Sold separately

WHAT YOU GET?

This Toolkit includes frameworks, tools, templates, tutorials, real-life examples, best practices, and video training to help you:

- Increase your M&A success rate with our 6-phase M&A approach: (I) Define your M&A strategy, (II) Identify target companies, (III) Build a business case and financial modeling, (IV) Conduct due diligence, (V) Execute transaction, (VI) Conduct post-merger integration

- Define your M&A strategy: (1) Company mission, vision and values, (2) M&A strategic objectives and key performance indicators, (3) M&A team, (4) M&A guiding principles, (5) Target screening criteria

- Identify target companies: (1) Potential target companies and data collection, (2) High-level assessment of potential target companies, (3) Shortlisted potential targets, (4) Financial statements analysis, (5) Business valuation: DCF model, comparable company analysis, and precedent transaction analysis, (6) Targets approved for the business case phase

- Build a business case and an M&A financial model: (1) Strategic benefit, (2) Feasibility, (3) Financial benefit, (4) Comprehensive M&A financial model including acquirer model, target model, merger assumptions & analysis, and pro forma model, (5) Simple Financial model including integration cost, revenue synergy, cost synergy, NPV, ROI, and IRR, (6)Letter of intent or term sheet

- Conduct due diligence(CDD) to identify the likely future performance of a company: (1) Work plan including key business case hypotheses and assumptions, (2) Due diligence to validate key hypotheses and assumptions, (3) Updated business valuation, (4) Recommendation to make (or not) a formal offer to acquire the target company

- Execute transaction: (1) Deal structure, (2) M&A negotiations, (3) Signing and closing the M&A deal

- Conduct successful post-merger integration to ensure the company reaches its cost and revenue synergy targets: (1) Post-merger integration strategy and high-level plan, (2) Post-merger integration detailed plans, (3) Implementation and monitoring

Related products

-

Sale!

Joe Troyer – Cold Email Masterclass

$497.00Original price was: $497.00.$35.99Current price is: $35.99. Add to cart -

Sale!

Amy Porterfield – Digital Course Academy 2021

$1,997.00Original price was: $1,997.00.$31.99Current price is: $31.99. Add to cart -

Sale!

The Ecom Wolf Pack – Dropshipping To Branding Course

$497.00Original price was: $497.00.$25.99Current price is: $25.99. Add to cart -

Sale!

Clients & Community – Prominence Partnership Program

$2,000.00Original price was: $2,000.00.$29.99Current price is: $29.99. Add to cart